Dear friends, I welcome you to my blog! Today, I'm going to talk about a very interesting ICO project. We will discuss how Zuflo applies blockchain technology in the innovation industry, and we will also discuss in detail the details of ICO. Before discussing the Zuflo ICO, it is important to have some historical background on the functioning of the ICO. Early Coins, also commonly referred to as ICOs, are fundraising mechanisms in which new projects sell the underlying cryptographic tokens in exchange for bitcoin and ether. This is somewhat similar to the Initial Public Offering (IPO) in which the investor buys the shares of the company.

ICO quickly becomes the dominant topic of discussion within the blockchain community. ICO is easily trained through technologies such as ERC20 Token Standard, which summarizes many of the development processes needed to create new cryptographic assets.

Zuflo.io aims to become a trading and financing platform for the Industry 4.0 era using technologies such as Blockchain & Artificial Intelligence to reduce the number of partners, reducing service costs and for end-users . Zufloo.io will enable platform users to improve efficiency, reduce errors, save time and direct processing without intermediaries, as well as artificial intelligence (AI) management tools.

In addition, Zufloo.io will enable / strengthen control and transparency in the processing of banking and commercial transactions.

Zuflo.io aims to be a platform for trading and financing for the Industry 4.0 era using technologies like Blockchain & Artificial Intelligence to reduce the number of counterparties, thus lowering the cost of services and for the consumer final with a state of the art new banking features. Zuflo.io will enable platform users to improve efficiency, reduce errors, save time and direct processing without intermediaries, as well as AI (Artificial Intelligence) management tools.

In addition, Zuflo.io will enable / strengthen the control and transparency of banking and commercial transactions.

PLATFORM BLOCKCHAIN / SIDECHAIN

Blockchain is an immutable shared register that provides the necessary visibility through the business network

Blockchain allows collaboration between multiple parties that may not know each other, or are located in different geographical locations. It's like a book of accounts that you insert information, similar to a database, he said, but once this information is there, it is extremely difficult to change. "Blockchain helps develop a level of trust". Especially in the financial sector, blockchain technology has a big impact. Buyers and sellers must have mechanisms they can know and trust to manage their financing, and blockchain is very actively driven in this area.

With blockchain, the participants in the transaction:

Share a single platform with secure access

Receive a complete view of the process

Are able to explore every step of the process

Can see the exact moment when a delay or error occurs

Remedy problems without filing a dispute

Ensure integration and quick installation without interruption

CHALLENGES WITH THE CURRENT COMMERCIAL SYSTEM

The ease of use / lack of usability: The sending and receiving of digital currency is always heavy, because each time the user decides to spend the cryptocurrency, he must visit three sites different to be able to carry out simple operations such as setting up a portfolio, making an exchange or passing a cryptocurrency. Users also lack confidence in the security of their funds.

Processing time for account verification is slow

High transaction fees

Lack of end-to-end visibility

Use incompatible systems

Support takes a long time

ZUFLO.IO AS A TRADING SOLUTION

Facilitate the entry into the crypto trade

Integration of FIAT and the Crptocurrency Exchange

disintermediation

The Trade-on-the-Go feature

Secure and secure wallet

Contemporary Trading Features (Spot, Margin Futures, DEX, etc.)

CHALLENGES WITH THE CURRENT FINANCING SYSTEM

Millions of global citizens have minimal access to banking services and are forced to sign lines of credit from informal channels with a annual interest of up to 4,000%. It's not that conventional banks do not want to serve more people, it's just that it's not profitable for them to do it in remote and less populated areas.

The digital transformation is lagging behind for SME financing. Getting short-term financing can be a daunting task, especially for small and medium-sized businesses that do not know the tricks. It is mentioned in a credible survey of small businesses that even with the advent of new online lending platforms, small businesses continue to struggle while seeking capital. The survey also revealed that 45% of loan applications were rejected more than once, and

23% were not aware of the reasons why their applications were rejected. Similarly, digital asset holders have limited liquidity options in today's liquid-based digital economy.

Ineffective Current Financing Platforms

Without blockchain, SME lenders can not:

Start business quickly and provide new value propositions

Improve spreads and margins

Reduce operational risks and costs

Comply with regulations between regions

Perform real-time accounting

Get a 360-degree view of each customer

Extract data and provide dashboards and customer reports in real time

ZUFLO.IO AS FINANCE SOLUTION - PROOF OF COMPANY IDENTITY SIDECHAINS

The financing sector is in dire need of new innovations to ensure an easy, transparent and accessible SME financing ecosystem. This is where Zuflo.IO comes in with its platform based on blockchain technology and smart contracts. Zuflo.IO is an ecology on which we can lend money to candidates against existing or non-active assets via Ethereums Smart Contracts technology. It is a loan and borrow network that allows users to leverage their blockchain assets for cash loans.

Access to financing

Integrating the disappeared population with the benefits of the global financial system is essential to provide a lasting solution to their future economic prospects.

Our blockchain-based platform enables easier auditability and greater operational efficiency, ultimately resulting in a lower loan cost than traditional service providers using centralized databases.

Financing identity

Zuflo would give candidates blockchain-based digital identities, which would allow borrowers to build their own economic histories and credit profiles, even if they are invisible to the existing banking system. The unique advantage of this parameter is the ability to use existing affinity networks to help create and verify the identities of borrowers. We not only provide financial services, we give them an identity related to everything a person does and it will serve as their "economic passport".

Powered by Ethereum Smart Contract

The essential feature of the platform based on Ethereums' intelligent contract technology means that it will be possible to check the health status of loans issued. At the same time, the confidentiality of critical user data will be preserved. Having borrowers' loan portfolios on a hacker-proof registry could serve the purpose of a transparent credit rating system.

Transparency for regulations

Initially, Zuflo would publish the entire history of the loans issued, including the currently active, paid and overdue loans on the Ethereum blockchain. In the next phase, Zuflo intends to publish the entire history of performance and current loan transactions in blockchain. This will make Zuflo completely transparent to government agencies, the borrower community, partners, current shareholders and potential investors. Our transparency policy will help borrowers, funds, current and potential investors in many ways, including predictability and accountability for investments. In addition, to protect the loan investment and the interest of the lender, all loans will be insured.

Platform for conventional and digital assets

In addition, the option of conventional assets Zuflo also allows members of its credit platform to value certain digital assets, giving them access to cash, offsetting tax events, avoiding the costs of changes and retains their long position on the assets they hold. Zuflo is a loan platform designed with blockchain assets in mind. Unlike traditional forms of collateral, such as real estate and auto, blockchain assets are divisible, fungible and, in many cases, immediately transferable. We seek to enable a new way to monetize an ever-changing universe of asset blocks.

Deposits and investments

Zuflo.io will offer the conventional digital deposit banking functionality to allow clients to earn margins on their assets or to borrow at a preferential rate. The investments will focus on low-cost risk securities, such as Exchange Traded Funds (ETFs), Crypto-funds (a portfolio of crypto-currencies and crypto-tokens), progressive ICOs, and asset management solutions. heritage. In the next phase, Zuflo will offer investment banking services, including financing the business strategies of our business clients.

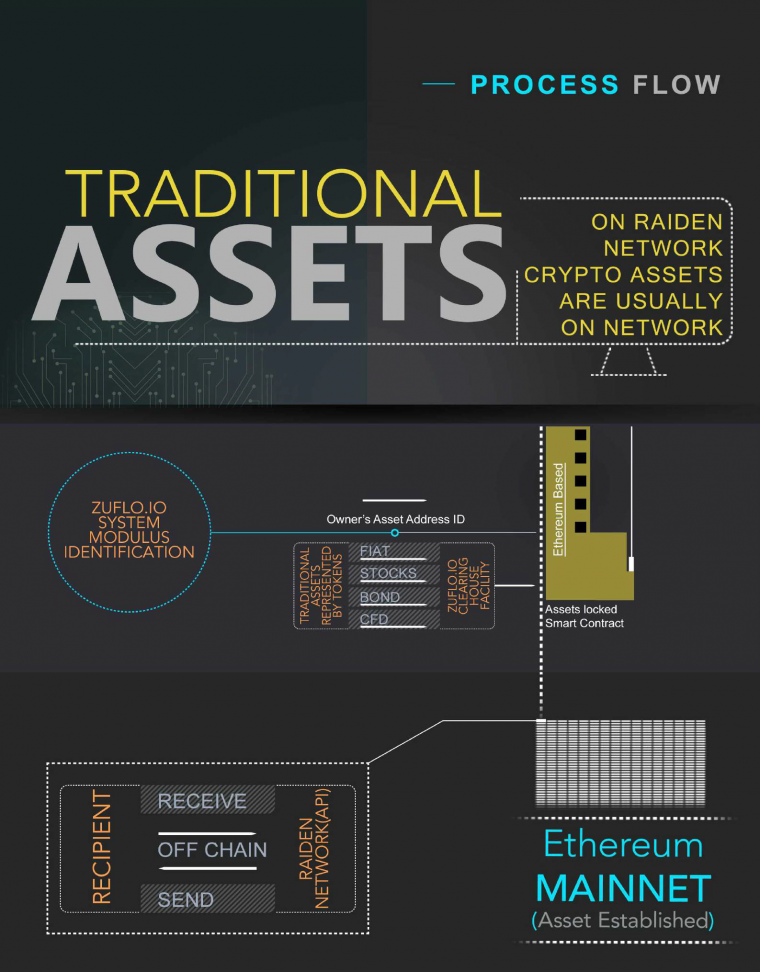

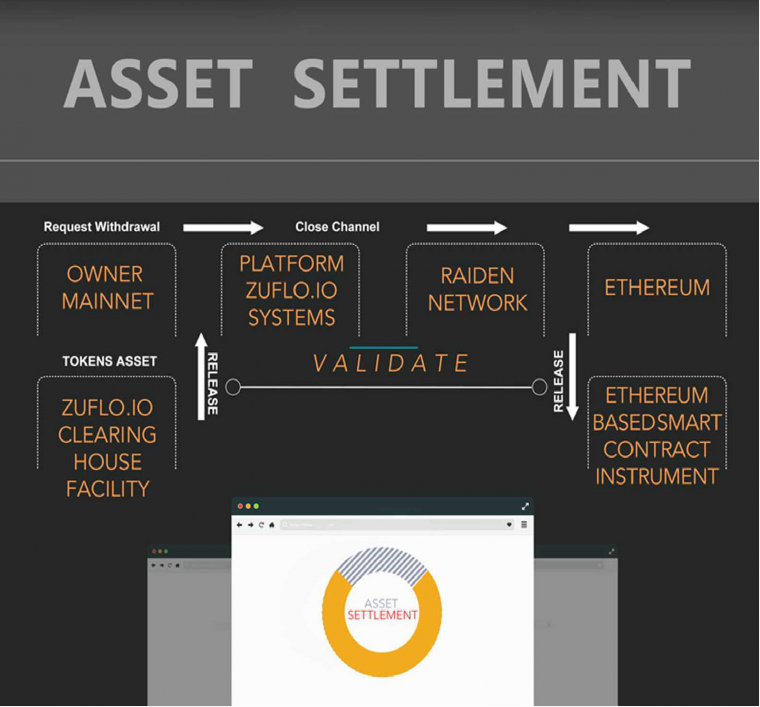

ZUFLO.IO TECHNICAL ARCHITECTURE

Architectural flow / process between the Raiden network and the destination

CHARACTERISTICS OF THE RAIDEN NETWORK

LISK SIDECHAIN BUSINESS IDENTITY PROOF CONCEPT

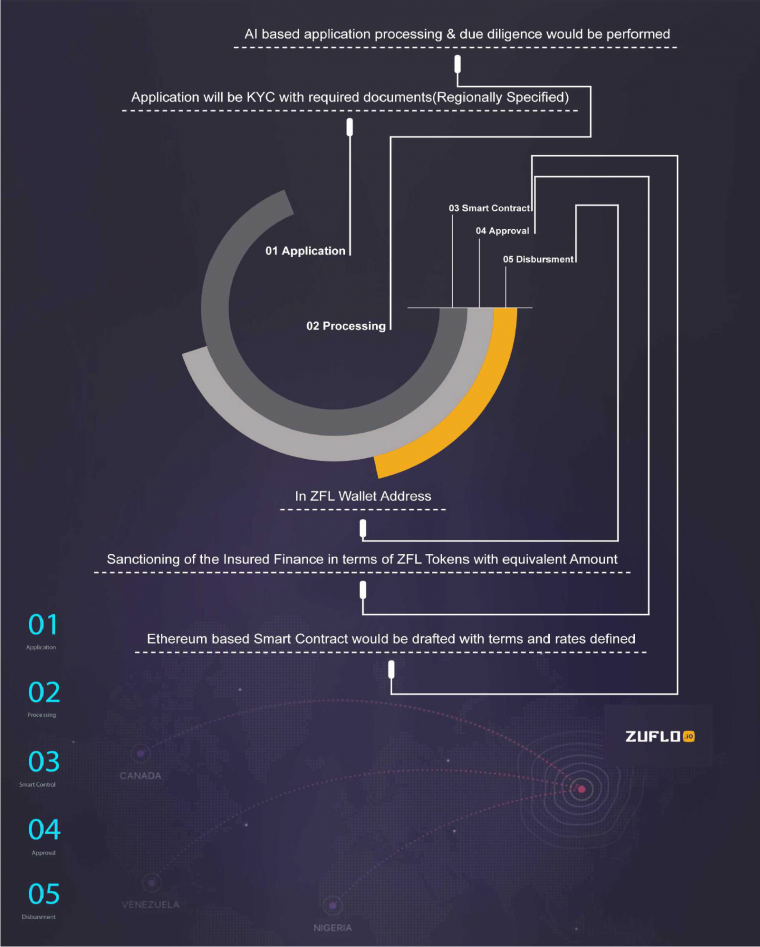

FINANCIAL APPLICATION PROCESS FLOWS

ZUFLO.IO ICO Detail

Project Name: Zuflo.IO

Project Description: Integrated Platform for Trade and Finance

Name of Token: Zuflo Coin

Ticker of Token: ZFL

Total Token Supply Limit : ZFL 500,000,000 ZFL

Bid Rate: 1 ZFL = US $ 0.36

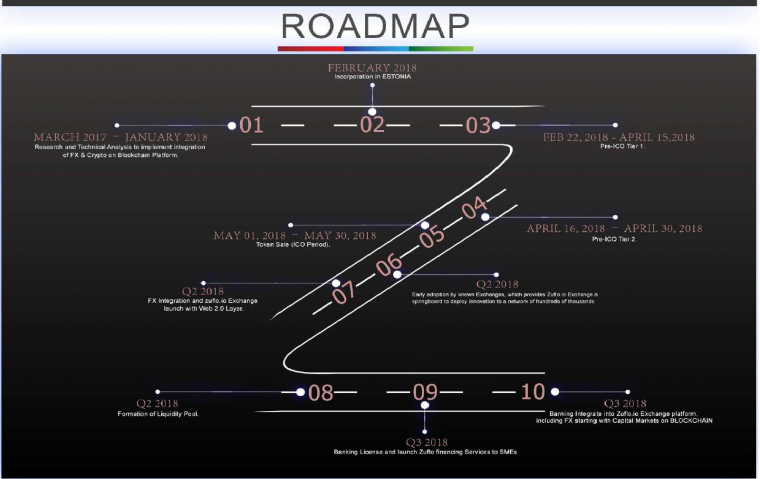

Sale of Tokens (before the ICO Period): From February 22, 2018 to April 30, 2018

Token Sale (ICO Period): May 1, 2018 to May 30, 2018 Pre-ICO and ICO Supplies:

ZFL 200,000,000

Pre-ICO Token Discounts: Level 1: 50% reduction to 0 , $ 36 From February 22 to April 15, 2018

Level 2: 30% discount to $ 0.36 From April 16 to April 30, 2018

Payment options: BTC, ETH, BCH

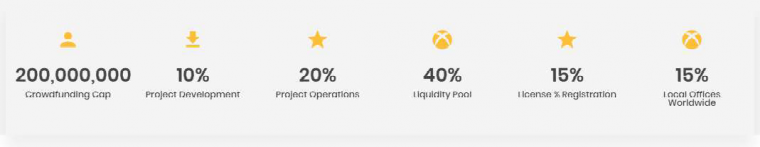

FUND ALLOCATION

ZUFLO.IO ROADMAP

ZFL TOKEN UTILITIES ZFL

is a utility token designed to facilitate the efficient trading of a wide range of assets on our stock exchange while also serving as a medium of exchange and store of value that could become more valuable depending on growth. users and the increasing use of trading. Platform.

Membership Key

ZFL is a membership key to the exchange platform and funding Zuflo

liquefiable

Post ICO, the token will ZFL liquidity since they can be traded on different exchanges

tokenization Average

entities and individuals would eligible to be "tokenized" or listed in the ZFL

Bonus and Payments platform

The user can use ZFL to participate in the ZFL shared liquidity pool to receive weekly or monthly bonuses

Commission disbursement

The ZFL-powered smart contract would allow a smooth allocation and distribution to referrals

Issuance of financing

Financing of the sales sector Retail Business, Based on Proof of Business Identity, Will Be Allocated to

ZFL Token ZUFLO.IO TEAM Borrowers

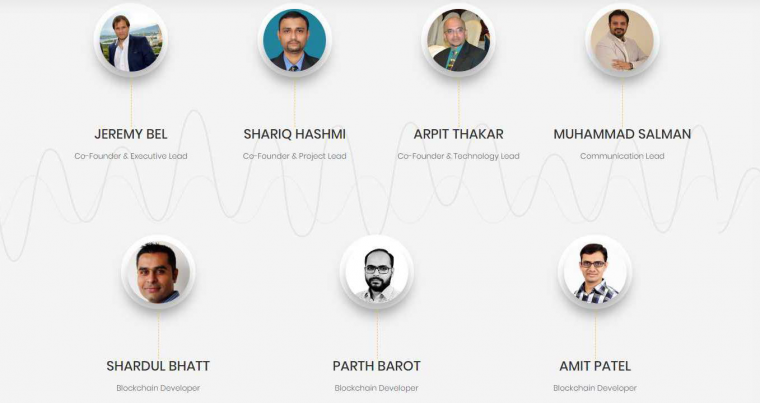

We are specialized trading professionals in software and FinTech with years of experience in the development of sophisticated trading algorithms and FinTech for financial and commercial institutions. Our team has a deep understanding of all the needs of professional traders, lenders and borrowers and we are very satisfied with what we can draw from the current state of the market in terms of trading, trading and financing. cryptomonnaie.

We are a strong and experienced team both technically and in the creation of successful startups. Each member has a unique trait that, when combined with those of other members, creates a perfect synergy. This ensures that the probability of our success is very high. We have years of demonstrable experience in this field and look forward to using it in the ambitious Zuflo.IO project.

TEAM PROFILES

Jeremy Bel - Co founder and CEO

Shariq Hashmi - Co founder and project leader

Arpit Thakar - Technology

Manager Muhammad Salman - Communications Manager

Shardul Bhatt - Blockchain Developer

Parth Barot - Blockchain Developer

Amit Patel - Blockchain Developer

ADVISORS

Zuflo.IO is proud to have one of the experienced industry advisers in their respective fields, and we are negotiating with some other experienced consultants.

Rumen Slavchov ICO Advisor - Strategy I (Top 12 ICO Bench Advisor)

Yuen Wong ICO Advisor - Strategy I (CEO Galaxy Esolutions)

Giovanni Casagrande I ICO Advisor - Marketing

Erickvand Tampilang I ICO Advisor - Community

Richard Trummer ICO Advisor - Strategy

Nikolay Shkilev I ICO First Consultant

Carl Jones I ICO Branding & Marketing Expert

More information:

Website: https://zuflo.io/en

Username: danil21

Eth: 0x4cEaD27a6A2aAEdAa44d35D8BF2a2c9370AbbE6a

Tidak ada komentar:

Posting Komentar